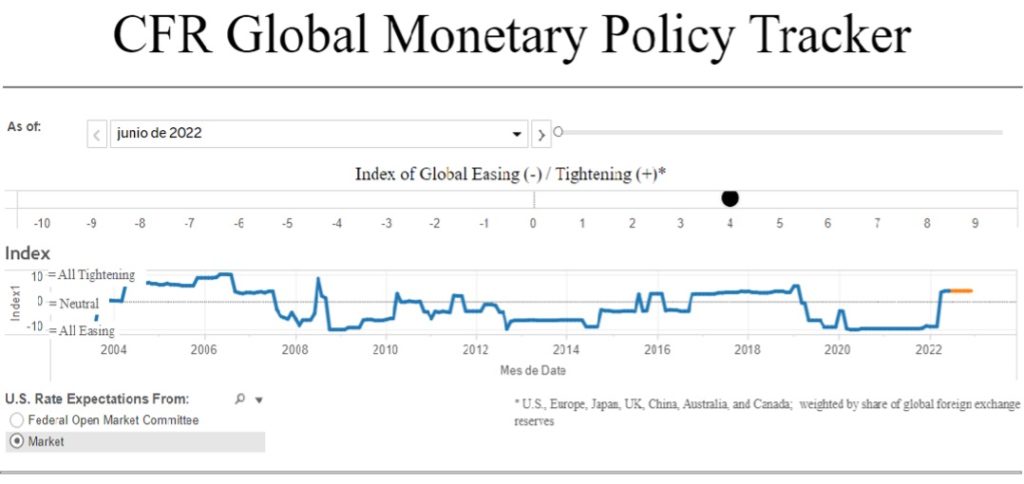

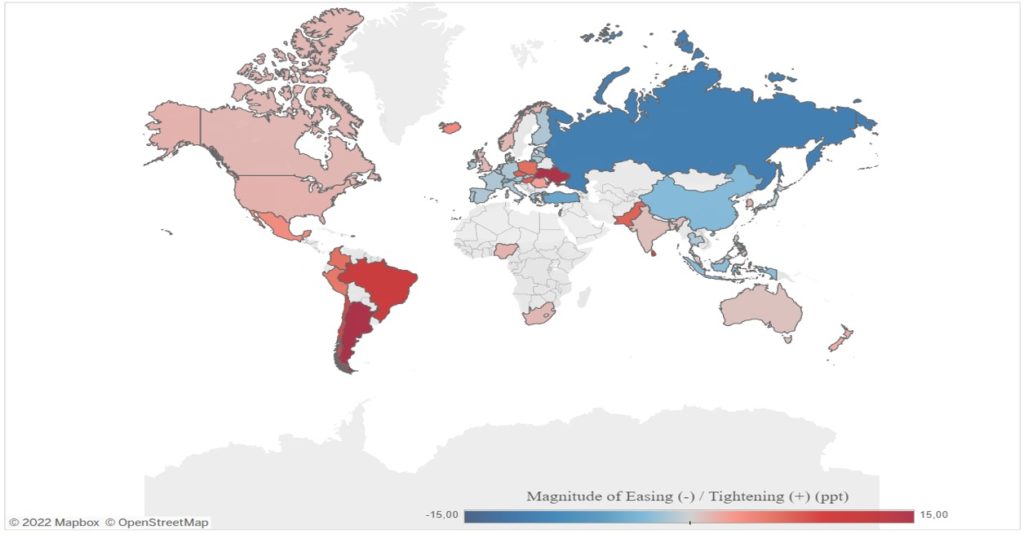

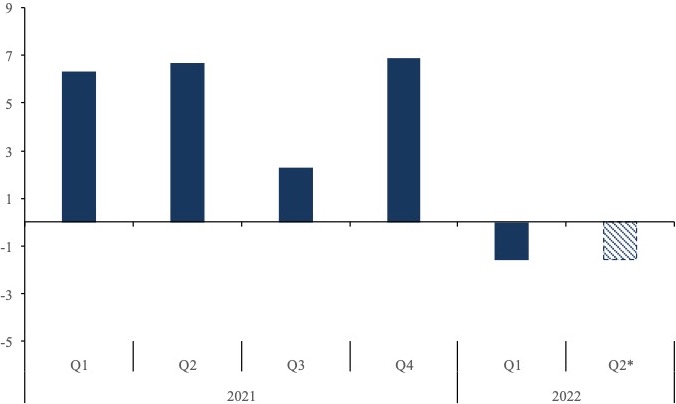

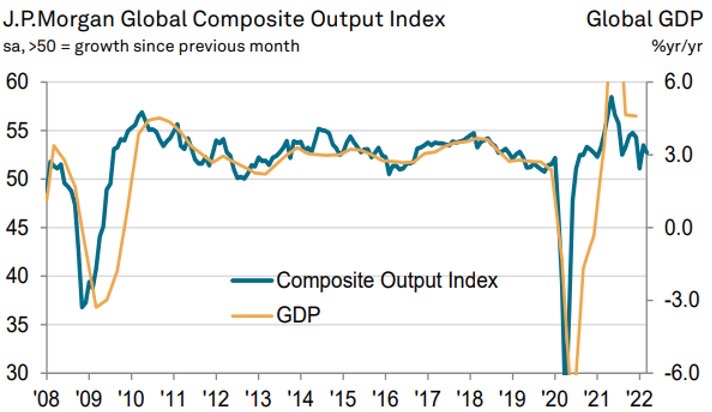

Yes, we think we have reached peak inflation fears but only in the short run. Economic activity has begun to slow down (i.e., Atlanta FED’s GDPNow suggests a -1.6% annualized contraction in the US economy for Q2 2022; strong deceleration is also evident in leading indicators in Europe and across the World, Figures 1 & 2) and commodity prices have seen a clear pullback lately (e.g., Cotton -34% since May, Wheat -42.6% since March, Copper -35% since March, among many others. Figures 3 & 4), at a time when central banks aim for a more neutral or even slightly restrictive monetary policy stance to control inflation.

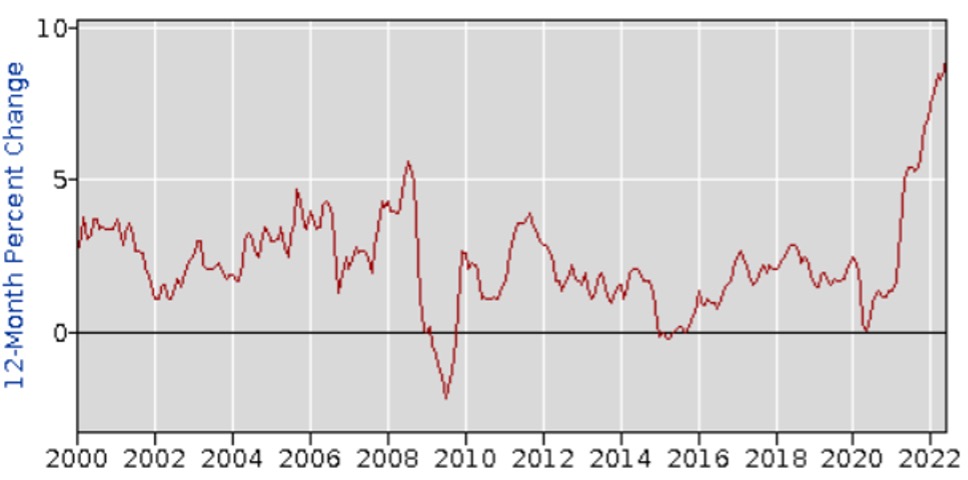

Under these circumstances, we believe we might have reached peak inflation fears, after the CPI recorded a new 40-year record growth of 9.1% in June (Figure 5). What comes next, we think, is a moderation in prices, with a loss of economic growth momentum and tighter financial conditions that might cause a mild recession around the world. Lower growth, less support to aggregate demand and high inventory levels should contribute to a scenario of disinflation (not deflation) throughout the second half of 2022.

Figure 1. U.S. Real GDP: Percent change from preceding quarter

Figure 2. Global Composite Output Index

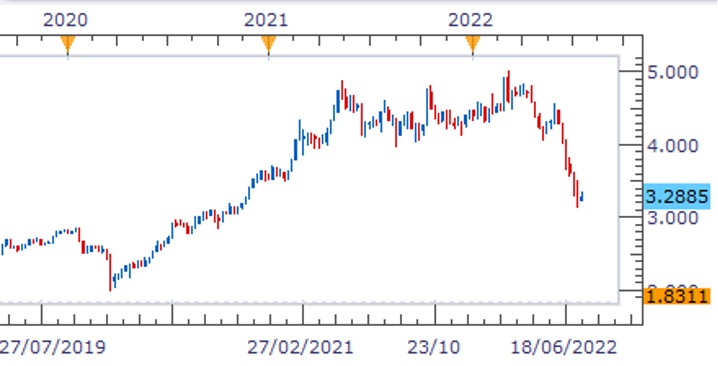

Figure 3. U.S. Wheat Fut. Price

Figure 4. Copper Fut. Price

Figure 5. CPI for All Urban Consumers

We are still under the strong influence of the shock caused by the pandemic and economic fluctuations, both on prices and growth, should be understood and looked at under this context. The deceleration of economic activity is the most probable and logic pathway after the strong rebound seen in 2021. The abnormal rise in prices seen throughout the last 12 months is also mainly a consequence or part of the noise of the pandemic shock, exacerbated by geopolitical shifts that won’t fade fast. Because central banks have engaged in the most aggressive cycle in decades to normalize monetary policy and tighten financial conditions in order to contain inflation (Figure 6), growth might see a sharper downturn before rebounding. Inflation should follow suit, as commodity prices ─which have been the main force behind higher global prices─ have already depreciated after a reaction in the markets to expectations of lower growth and a probable recession. This might prompt central banks to stop hiking rates towards the end of the year, maybe even scale them back if the slowdown is more severe than anticipated. But we do not expect low inflation and low interest rates to be the dominant trend in the medium and long run.

We expect aggregate demand to wane in the second half of the year, especially consumption for durable goods and discretionary spending among households, as a result of higher interest rates. But we do not expect to see a significant impact on consumption for basic goods, which have lower elasticity and have been favoured by changes in consumption patterns since the pandemic. This assumption is one of many at the core of our expectation that we will only see a temporary moderation of inflation and a minor pause of financial conditions’ tightening. We do not believe we are going back to a regime of low growth and low inflation, as it has been the case in the last decade (i.e., 2009-2019). Changing dynamics in advanced economies’ labour markets and increasing labour costs might still put pressure on businesses margins. More so, the lack of investment in the preceding years and especially, but not only, in the energy sector, might keep production costs high for businesses.

Higher interest rates might affect the less profitable firms, the so called “zombie” companies, that rely on credit and low interest rates, and keep supply limited. It is important to remember that inflation pressures come mainly from supply side problems (not demand side) that might not resolve fast. We believe chronically low CAPEX for productive investments in the real economy ─ a consequence of ¨ultra-cheap money¨ and capital misallocation during the last decade─ may extend these problems; alongside geopolitics, socio-political change and the pandemic. All these factors might contribute to more structural inflationary pressures towards 2023 and beyond. We expect still higher interest rates relative to the last decade and anticipate central banks (particularly the FED, the most important for the global economy) to pause only briefly the hiking rate cycle towards the end of this year. However, they could restart in 2023 as inflation might stay above their target. This implies a new investment landscape compared to the 2009-2019 decade that, in our view, will present itself with several investment opportunities, such as:

Long US Bonds – This is a tactical trade. We expect yields to fall in the coming months, especially in the medium-long end of the curve (i.e., 5-30 years). As economic indicators confirm a sharp slowdown in the US economy and a high probability of this being the start of a recession, bonds could be repriced. Using the US10y as reference, yields could come down from 3% to a range between 2%-1.5%. However, in the mid-long term, we still recommend positioning for a rise in rates towards 5%.

Long China – The Chinese economy seems to be in a cycle opposite to that of the US: while the US is entering into recession, China is headed for recovery. Given the attractive valuations in Chinese equities (MSCI China P/E Forward 10.73, vs. 11.39 MSCI EM or 15.26 MSCI ACWI; P/Book Value at 1.39 for MSCI China vs. 1.72 MSCI EM and 2.69 MSCI ACWI) and the cyclical upturn expected for the economy, we see a good opportunity in building up positions in this space. But risk management is of the utmost importance in this trade. Keep eyes wide open and pay close attention to the risks in the housing and banking sectors, which are under turbulent conditions and might be a trigger of a ¨financial accident¨.

Out-of-the-money calls for commodities – We believe it is the right moment to buy out-of-the-money call options for commodities. We think there are very attractive risk-reward opportunities now that commodity prices are falling and economic growth perspectives are low. We think some of the best opportunities in the asset class are in buying call options for Corn, Wheat, Oil, Coffee and Natural Gas with a 12 month forward or longer expiration dates, looking for the appreciation of these assets ahead of reflation. DBA (an ETF that gives exposure to Agricultural commodities) can be an alternative, where a less volatile performance can be expected, instead of buying soft commodities out-of-the-money call options.

Consumer Staples value opportunities – KHC among others, for example, is paying a dividend yield of around 4% and, in our view, presents an interesting upside potential with a mid/long term investment horizon to around $51 (34% upside potential from its Jul. 15th close price $38.01) and a P/BV around 1. We think it is worth looking at the whole sector under a deeper analysis for more opportunities.

Long Platinum, Silver and Gold – Platinum, Silver and Gold are reaching very attractive levels and could prove to be good investments in our base case and alternate scenarios. Even with a long-term investment horizon, precious metals offer an attractive risk-reward. This trade might play out in a longer time horizon (i.e., around 12 months), but the tactical opportunity, we think, is to buy them now, near July 15th close levels($1,700-$1,600).

Long AE commodity-related currencies and short EM currencies – We believe there are good opportunities in the FX market. An extension of the USD appreciation in a “higher for longer” interest rate scenario could be played through short positions against EM currencies that have held strong so far (i.e. MXN). Also, ahead of 2023 we favor building long positions on currencies of commodity-producer countries, like AUD and CAD.

Alternate Scenario

There is a chance that disinflation gives way to deflation. For example, a severe recession caused by a financial crisis or a “financial accident”, consequence of fast rising interest rates (i.e. a debt or credit crisis), could prompt a sharp contraction in growth and a dissipation of inflation pressures. Also, the effect on prices from the inventory build-up in recent months could contribute to this scenario of deflation. Under this scenario, inflation would fall not only temporarily, but more permanently. It is difficult to envision deflation without a disruptive event, but a financial crisis and excess inventories could be the main forces behind a deflationary scenario. This could mean a return to the 2009-2019 regime. If deflation takes hold, it would be wise to expect central banks to reinstate monetary stimulus (i.e., QE, low interest rates) and the outperformance of financial assets with long duration (i.e., bonds, tech). EMs could also become attractive (not only equities, but currencies too) and non-conventional investments could see a come-back (e.g., Bitcoin and crypto). Dollar depreciation could become the norm and, in the medium to long term, negative interest rates will be in the horizon.

Only time will tell, and markets will dictate the facts, we will be open minded and paying attention to events as they unfold so we can adapt our positioning and views accordingly. We will be careful to keep thinking in a probabilistic fashion, never in absolute terms.

Disclaimer

This report contains forward-looking statements within the meaning of the federal securities laws. Forward-looking statements are those that predict or describe future events or trends and that do not relate solely to historical matters. For example, forward-looking statements may predict future economic performance, describe plans and objectives of management for future operations and make projections of revenue, investment returns or other financial items. A prospective investor can generally identify forward-looking statements as statements containing the words “will,” “believe,” “expect,” “anticipate,” “intend,” “contemplate,” “estimate,” “assume” or other similar expressions. Such forward-looking statements are inherently uncertain, because the matters they describe are subject to known (and unknown) risks, uncertainties, and other unpredictable factors, many of which are beyond FESC Asset Management, LLC control. Actual results could and likely will differ, sometimes materially, from those projected or anticipated. We are not undertaking any obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise. You should not take any statements regarding past trends as a representation those trends or activities will continue in the future. Accordingly, you should not put undue reliance on these statements.

Actual results may vary substantially from past performance or current expectations. FESC makes no guarantees and no representations whatsoever related to any forward-looking statements or future results or events. The information contained herein is believed to be accurate as of the date of preparation, and FESC reserves the right to change and/or update such information at its sole discretion without prior notice. Investments are subject to market risk, including the complete loss of principal. Asset classes or investment strategies described may not be suitable for all investors. Equities and all other asset classes discussed herein are subject to market risk meaning that stock or asset prices, in general, may decline over short or extended periods of time.

The information contained does not consider any investor’s investment objectives, particular needs, or financial situation. Nothing in this material constitutes investment, legal, accounting, tax advice, or a representation that any investment or strategy is suitable or appropriate. FESC and its personnel gathered this information from publicly available sources, and we do not guarantee its accuracy.

The information herein is only a summary and does not purport to be complete. The information contained herein has been prepared by FESC solely for informational and discussion purposes only and is not for public distribution. This report does not constitute an advertisement, an offer to sell, or a solicitation of an offer to buy any securities or investment advisory services and is intended for informational purposes only. This presentation is strictly confidential and may contain private, proprietary, secret, and commercially sensitive information and may not be reproduced in any way or form or disclosed to any other person without the previous written consent of FESC.

Investment advisory clients, employees, and employee-related accounts may engage in securities transactions inconsistent with this report.

The above information is subject to change without notice. Additional information is available upon request.