MacroView in a nutshell:

- The scenario outlined in our last MacroView has not changed. We still expect higher interest rates and persistent inflation, despite the likelihood of a downturn in growth towards the end of 2023.

- The consensus view, suggested by rates in the bond market, is that recession is unavoidable, inflation will eventually recede, and interest rates will come down. This belief has been reinforced by the turbulence in the US and European banking sectors in the past few weeks.

- What markets are pricing now is a Fed pivot, a complete reversal of the interest rate hiking cycle, given the financial instability concerns and the expected effect of the banking crisis in the economy.

- However, the consensus view isn’t convincing enough for us. We are not convinced that the problems in the US banking sector are systemic. They seem to be very specific, and we remain of the idea that a mild recession (or cyclical downturn) will not be enough to dissipate inflation concerns.

- With a surprisingly strong US economy, and China in the cusp of recovery, it is unlikely that inflation will decelerate massively. Under this scenario, we still expect Fed Funds to rise to 6%-7%.

- Positioning and investment ideas: Long Gold and Silver, Long Chinese equities, exposure to Credit spreads widening, Long defensive stocks and Long agricultural commodities and Oil.

The scenario outlined in our last MacroView continues to unfold. Financial instability has intensified, core inflation is still growing above its pre-pandemic pace and, although there are still no obvious signs of an imminent recession, a sensible slowdown in growth is still the most likely scenario towards the second half of 2023. The key questions remain unsolved: Will a recession trigger disinflationary pressures? Or have inflation dynamics become structural and higher prices will persist despite a cyclical downturn? We consider the latter as the most probable scenario, but any attempt to tackle the question is just guesswork. There is still a high level of uncertainty. Markets, however, are trading based on the hope of a mild recession, a Fed intervention and lower inflation. Something contradictory, in our view.

The consensus view, suggested by rates in the bond market, is that recession is unavoidable, inflation will eventually recede, and interest rates will come down. This belief has been reinforced by the turbulence in the US and European banking sectors in the past few weeks, after the collapse of Silvergate Capital Corp., Silicon Valley Bank Financial Group and Credit Suisse Group AG. These events evoked memories of past financial crises and resulted in a broad risk-off sentiment amongst investors and an increased expectation for a Fed pivot: markets are pricing aggressive interest rate cuts in the short term.

In the financial system, risk aversion and fears of contagion reduced the liquidity available for the most vulnerable banks, especially regional banks in the US and stressed banks in Europe. Anecdotal evidence suggests individuals in the US have begun to move deposits from regional to top tier banks, because they are afraid their money is unsafe; something that essentially constitutes a “bank run”.

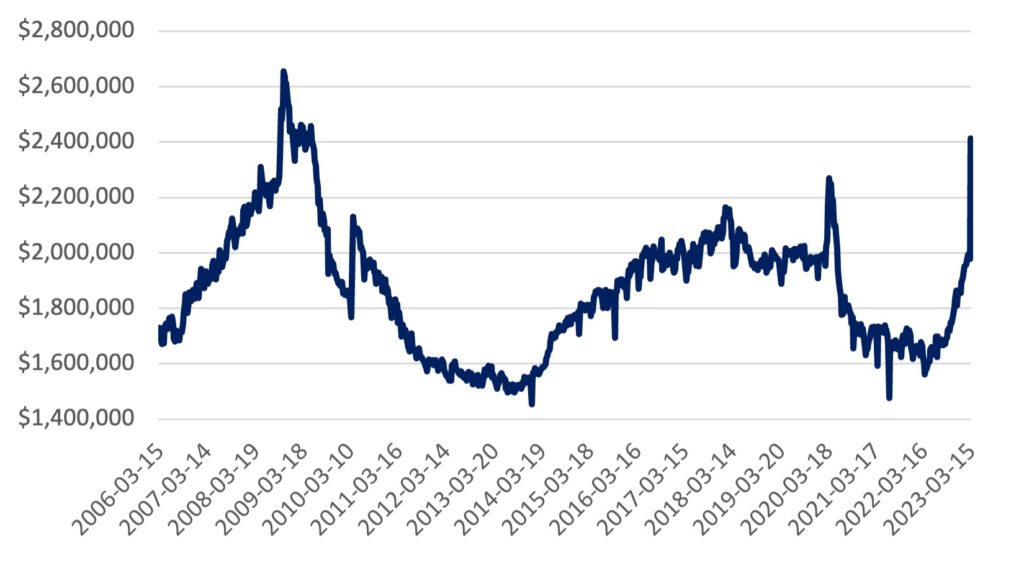

This confidence problem in the banking sector was backstopped by regulators, who reinstated that they would guarantee all deposits under the FDIC and got support from a new lending program by the Fed (the Bank Term Funding Program or BTFP). Banks immediately made use of the new lending program and even resorted to the more traditional discount window of the Fed to solve liquidity problems. It is estimated that banks borrowed around $165 billion dollars in aggregate from the BTFP and the discount window during the week of March 15th, with little change to that volume by March 20th. Just from the discount window $152.85 billion were borrowed. Moreover, the Fed went further to resolve any liquidity concern globally by re-establishing USD SWAP lines with major central banks around the world after the collapse of Credit Suisse. I sum, aggregate borrowing in the US banking sector has risen sharply (Fig. 1), almost matching the liquidity needs of the GFC.

Figure 1 - Borrowings, all commercial banks (USD Millions)

For many, this is a clear sign that recession is around the corner and that the Fed is about to radically change its monetary policy stance. The argument goes like this: high interest rates are already affecting the most vulnerable institutions in the banking sector; this will translate to a more conservative approach towards lending and trigger a slowdown of credit growth. Ultimately, this means less support for consumption and investment (aggregate demand) and, thus, a probable recession and lower inflation. The greater risk is that the liquidity problem extends further and becomes a profitability or even a credit crisis. So, what markets are pricing now is a Fed pivot, a complete reversal of the interest rate cycle given the financial instability concerns and the expected effect of the banking crisis in the economy. As of writing, Fed Fund Futures point to a 5%-5.25% terminal rate by May-June, before the Fed starts to cut rates at a constant pace of 25bps in almost every monetary policy meeting into the second half of 2024. The Fed Funds rate is expected to reach 3.25%-3.50% by September 2024, according to this market. This is a very aggressive path lower for interest rates, given the inflationary environment we live in. It means markets either expect a deep recession that swipes out any inflationary pressure, or a Fed that changes priorities and becomes more concerned with growth and financial stability than with bringing inflation into control. The faith in the Fed pivot is reflected also in equity prices, with the S&P500 declining ‘only’ (-)6.8% between March 8th and 13th, when the market seemed to bottom out, at least temporally. Under the context of bank failures, it is quite a “shy drop”, which, from our perspective, says a lot about the hope on the FED to pivot.

However, the consensus view isn’t convincing enough for us. We still believe markets are trading on hope and hope is not a strategy. Although the collapse of some banks is of concern, it is important to remember that Silvergate was exceptionally exposed to cryptocurrency risk; SVB was highly exposed to interest rate risk and the business was highly reliant on venture capital (very sensitive to an adverse interest rate environment); and CS was already an unprofitable business, with a questionable management, trying to survive. The most recent bank to feel the pressure in its Credit Default Swaps is Deutschebank, a well-known case that has undergone scrutiny for several years.

As we put it in our last MacroView, it was a matter of time this would happen, something had to give and break after decades of near zero interest rates. But these are the points of least resistance, and it is still not clear this crisis in the banking sector will be enough to derail a resilient economy. Especially if the Fed has become talented in the business of backstopping liquidity problems via emergency lending programs.

Don’t get us wrong, we don’t mean to say we won’t get a recession. We think we will. But we are not convinced that the problems in the US banking sector are systemic. They seem to be very specific, and the Central Banks have become experienced in averting contagion from this kind of complications. The Fed could always guarantee liquidity to banks, lend them using liquid assets as collateral. Even if banks have massive unrealized losses for their investments in Treasuries, the Fed has already granted them loans taking them as collateral at par. Ultimately, we think the liquidity crisis won’t go further. The impact of tighter lending could accelerate the start of a recession, but not necessarily a deep one. And we are of the idea that a mild recession (or cyclical downturn) will not be enough to dissipate inflation concerns. A more protracted recession is needed for that, and we still have no obvious signs of it yet. Inflation remains, for us, the main concern for investment decisions. Financial instability and vulnerabilities should continue to be monitored, especially if the stress in the global banking sector translates into stress in the broad credit markets. But by now, the turbulence in the US and European banking sectors could be just a blip, as it happened with pension funds and the BoE in the UK, or the BoJ and yield curve control at the end of 2022.

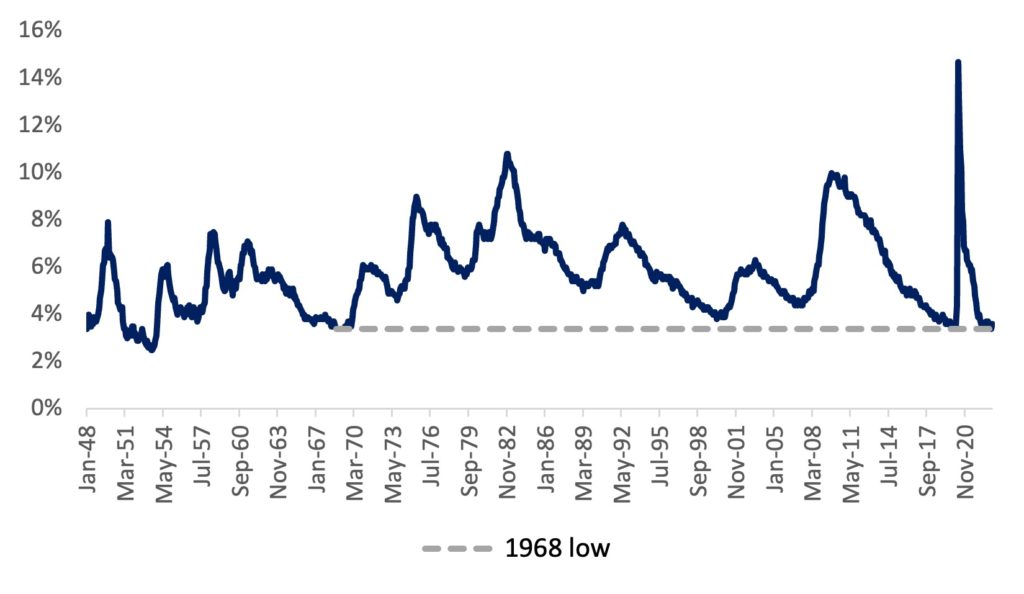

For the moment, the US economy remains surprisingly strong. We are already 12 months past the start of the rate hiking cycle and no clear signs of a broad downturn in growth is obvious. The labour market remains resilient, with the unemployment rate still in pre-pandemic levels (3.6% in February; Fig. 2) and near its lowest level since the late 1960’s. There are 1.9 job openings for every unemployed, according to January data, which highlights a persistent lack of workers and a very tight labour market that still poses risks of upward wage pressures. Consumption is certainly off its peak but remains quite strong despite much higher interest rates and prices. The labour market’s current condition is, for sure, helping US households to keep up spending. The last retail sales data available showed strong demand during January (Core retail sales +2.3% MoM) and kept growig in February (0.5% MoM). For the overall economy, the Atlanta FED GDPNow estimate for Q1 has persistently been revised upwards, from 1% annualized in mid-January to just above 3% by mid-March. That is not a slowdown from the 2.7% in Q4 2022; the economy is still growing, at least at a constant pace.

Figure 2 - US Unemployment Rate

Of course, there are some weak spots, particularly in the interest rate sensitive sectors of the economy. Housing is one of them. Mortgage applications and overall sales have continued to cool down (on new and existing homes), after the increase of mortgage rates. House prices have started to come down as a response to lower demand, and overall activity in the sector is moderating. But we are far from a severe slowdown. At most, the housing sector is normalizing after an exuberant post-pandemic boom. Moreover, there are some early signs that the downturn might be bottoming out, with construction of new homes at its highest since 2006 (as homebuilders replenish inventories) and home affordability at its best level since August 2022. In the auto industry things look grimmer, with prices still high and an adverse interest rate environment for financing consumption. Retail sales for auto and motor vehicle dealers have contracted during the first two months of the year. However, this seems to be far from a general trend in the economy. Weakness is not showing in the services sector, the most relevant for the US economy, as it represents around 77% of GDP.

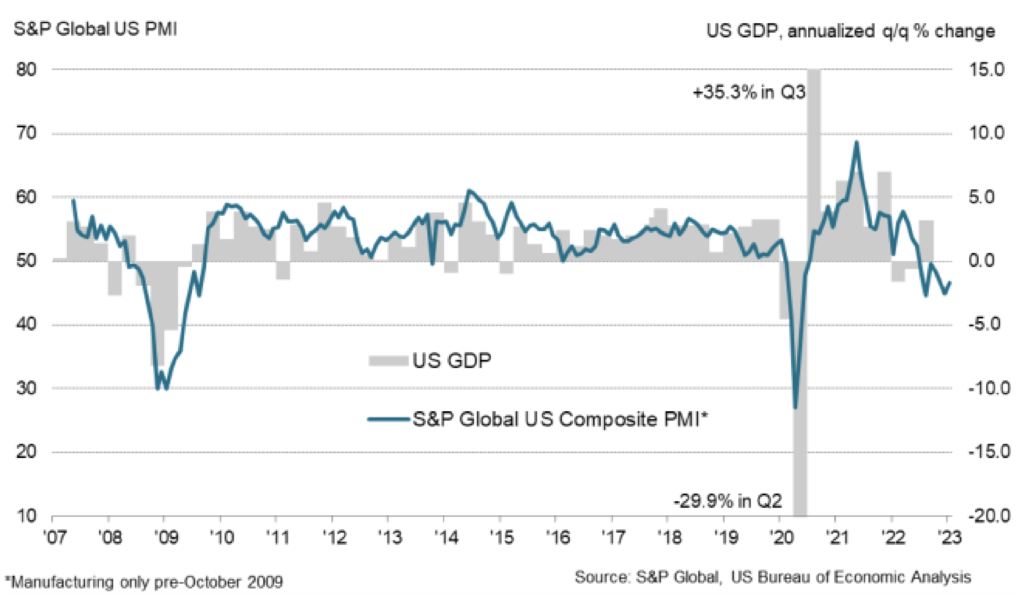

The most concerning signs of deceleration in previous months appeared in the leading indicators, especially the S&P Global PMIs (Fig. 3), that have signalled contraction in economic activity since July 2022. But in February and March a recovery has taken place. At the same time, the ISM leading indicator for services is still signalling expansion and is near its pre-pandemic levels. In sum, there are no signs of a worrying deceleration of the US economy in the available data.

Figure 3 - S&P Global Flash US PMI Composite Output Index

The other engine of global growth, China, is still on the cusp of recovery. The reopening of China has not yet brought an explosive reacceleration of economic activity, but the conditions are set for strong growth when confidence is recovered by consumers. The worst of the Chinese housing crisis seems to be behind us and some indexes of home prices in the country have begun to recover. Cash holdings by Chinese households are abundant, with an estimate increase of 8 trillion RMB (ca. $1.16 trillion USD) in bank deposits during 2022: cash waiting to flow back into financial assets and general spending once confidence is restored. The outlook for the Chinese economy is brighter than in other corners of the world and growth in China could compensate for any deceleration in the US, particularly for economies in emerging Asia and exporters to China. Geopolitical considerations are worth looking at when trying to measure the spill-over effect of Chinese growth, but winners will abound in the European export sector, while Russia might be more resilient despite the long and protracted war in Ukraine.

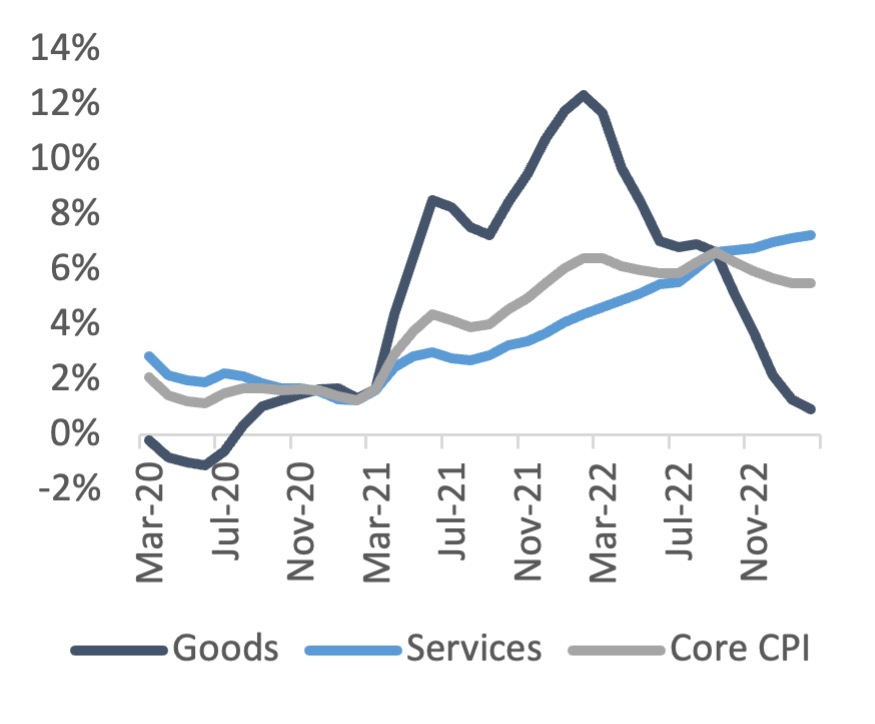

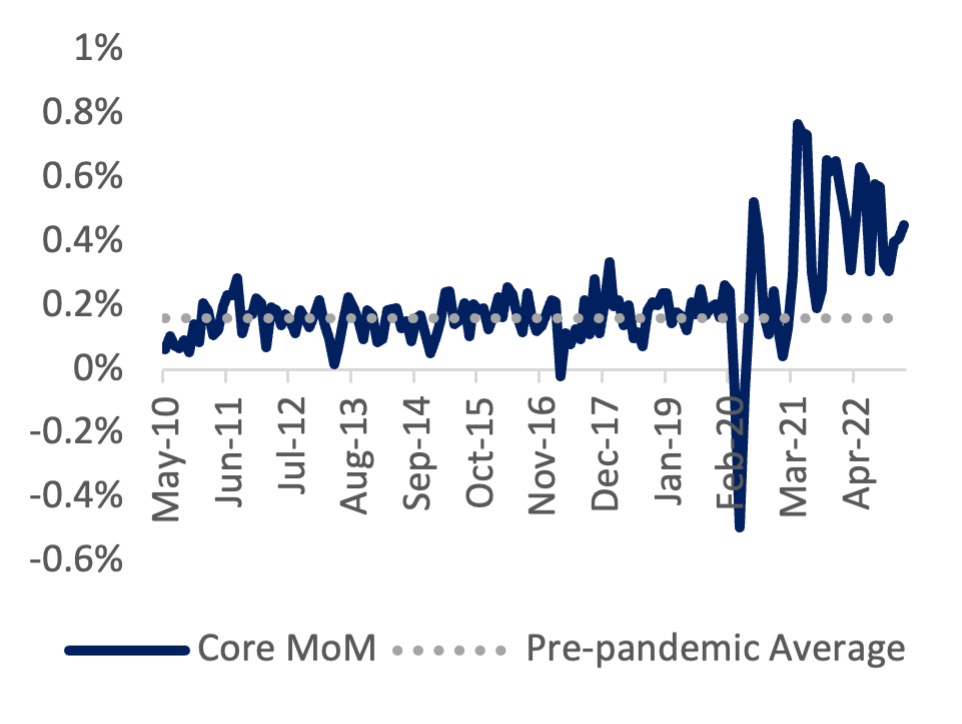

With a surprisingly strong US economy, and China in the cusp of recovery, it doesn’t seem to us inflation is set to decelerate massively. Inflation dynamics in the US show still rising prices for services, and a loss of momentum in disinflation from goods (Fig. 4). This is quite relevant, because good’s prices disinflation contributed decisively to the fall of CPI in late 2022 and early 2023. Headline inflation has come down to a 6% annual rate, its lowest level since September 2021. But core inflation is still rising above its pre-pandemic monthly average (Fig. 5) and in February it rose 0.5% MoM, the highest of the last 5 months. Shelter costs kept accelerating and registered a 0.8% rise in the month, while all services logged in a 0.5% increase (the most since September). There are no clear sings of moderating inflation pressures. In any case, data seems to confirm a more persistent inflation in the services sector.

Figure 4 - US Core CPI (YoY)

Figure 5 - Core CPI (MoM)

Under this scenario, we still expect Fed Funds to rise to 6%-7% before any real containment of aggregate demand pressures on prices can be achieved. Monetary policy is still not restrictive enough, we still expect a real ex-ante (short term) interest rate of 2% or above. Without that, inflation could become entrenched. Add the fact that a materialization of a Chinese recovery could reinforce global inflationary pressures: the task for Central Banks is far from over. The war in Ukraine still poses risks for energy and food prices, and projections of long-term supply deficits in those markets suggest costs of living are still expected to rise from here. Another structural inflationary dynamic to keep in mind is salary pressures. Those have kept mostly contained in the past few quarters, but they could accelerate if labour markets remain strong and high inflation becomes a sticky point in wage negotiations.

Moreover, some market dynamics reinforce our belief that financial conditions aren’t tight enough to bring inflation back down to target. Even with the high stress and liquidity problems in the US and European banking sectors, spreads between high quality and junk credit yields remain below its July 2022 levels and at its 2010-2019 average (Fig. 6). That is, liquidity and capital market access is still wide open for risky and uprofitable businesses that issue debt for financing. The credit market conditions have not worsened dramatically despite increasing interest rates in the last 5-6 months. As long as these businesses keep favourable access to credit, it seems difficult to think of a severe downturn in economic activity. Other, more encompassing financial conditions’ indexes also show that access to capital has not deteriorated significantly as of late[1]. The Chicago Fed National Financial Conditions Index (Fig. 7[2]) shows that financial conditions have loosened between October 2022 and February 2023, with a visible tightening in March given the stress in the banking sector. However, the index is still below the peak reached in October, reaffirming that financial conditions are looser or, at most, the same than in late 2022. Similar indexes produced by Goldman Sachs and Bloomberg show the same behaviour.

[1] These measures not only take into account credit spreads, but also the strength of the US Dollar, Equity market levels and the interest rate yield curve, amongst other factors.

[2] Positive values of the NFCI indicate financial conditions that are tighter than average, while negative values indicate financial conditions that are looser than average.

Figure 6 - ICE BofA US High Yield Index Option-Adjusted Spread

Figure 7 - Chicago Fed National Financial Conditions Index

Financial conditions have not tightened as expected because markets don’t believe the Fed will keep rates high for long. If markets keep betting on a Fed pivot or, worse, if the Fed pivots, inflation might get out of control. That is not to say it will reaccelerate; it will just become much more persistent and might not come back to the 2% target. Given what has happened in 2023 so far, we believe a scenario of mid-term inflation above 4% is not farfetched.

For the following months, it is important to keep an eye on financial conditions and how they evolve along with inflation. An aggressive widening of credit spreads and the tightening of broader financial conditions would be a clear indication of a recession coming our way. The level of inflation at that moment and the Central Bank’s response to the recession are key factors to observe when making investment decisions. If inflation remains high, as we expect, Central Banks won’t have much space to respond to a downturn in economic activity, something that might catch markets off-guard. Markets got used to Central Banks intervening when things ‘got bad’ in the growth front over the last two decades. Now they might not have that reassurance, and, if they get it, we run the risk of high inflation and unhinging inflation expectations. For the market to expect a positive outcome in a scenario where recession takes place and the Fed steps up to avoid the worse, as has happened before, is complete nonsense. It is, in our view, contradictory. Our argument goes both ways: you cannot have a mild or managed recession and at the same time low inflation; but you also cannot have low inflation without a sensible (if not severe) recession. Markets have still to adjust to that reality.

Alternate Scenarios

Our alternate scenarios have not changed since the publication of the latest MacroView (November 2022). The scenario where “the Fed blinks” seems to be gathering more traction. There is a higher probability of this happening than it was a few months ago. But in the end, the scenario is not much different from our base case: higher rates will ensue sooner or later, with risks of persistent inflation and unhinging inflation expectations.

- The FED blinks – The Fed could stop hiking rates in mid-2023, either because a more pronounced deceleration of growth takes place or because of continued financial instability. Whichever the case, this poses a high risk for a more entrenched inflation and the unhinging of inflation expectations. This could prove costly. As we outlined in previous reports, this could prompt a scenario where the Fed would have to restart rate hikes sooner than later (a “stop-and-go scenario”) and reinforce stagflation.

- Inflation comes down – Although inflation pressures remain strong, a scenario where inflation comes down fast is not out of the cards. But we think this would have to come in the form of a deep and protracted recession that wipes out any inflationary and salary pressures. So far, there are no signs of such a deep recession (dares us say depression). But in a fast-evolving environment, conditions must be constantly evaluated. A deep recession is still a distinct possibility, given the steep increase of interest rates and the high levels of debt around the world.

Investment opportunities

We recommend keeping an eye on a few dynamics when making investment decisions. Credit market spreads in the US will be a great barometer to measure financial conditions and recession risks. Also, keep an eye on the Bank of Japan. We believe that when the BoJ abandons Yield Curve Control or allows a wider fluctuation of 10-year JGBs, US and European credit markets might suffer a drainage of liquidity, as Japanese pension funds repatriate capital. Also, don’t lose sight of inflation and its dynamics; salaries will become more and more important throughout the year if we don’t get a deep recession. And, finally, monitor inflation expectations through US Treasuries’ break-evens. The anchoring of inflation expectations or its unhinging is key to understanding what might come next.

Long Gold and Silver — We believe precious metals have already started its rally to new highs in the medium and long term. They still present attractive risk-reward ratios and it is still a good time to build positions in these assets. Platinum is also an attractive asset to play the same idea. We see a strong potential for precious metals in all the probable scenarios described above: a long-lasting inflationary environment with risks of unhinging inflationary expectations; low growth; or in a scenario where the Fed stops rising rates and real rates compress.

Long Chinese equities — After an initial rebound in Chinese equities during the last two months of 2022, prices have come back down in this space. It is now a good moment to build positions again. The risk-reward is very attractive and, given that an initial rally has already taken place, the trade can be carried with much less risk than four months ago.

Credit spreads widening — Due to the pace of rate hikes and inflationary forces that erode margins and growth, we expect a violent move in the next quarters on credit spreads. We are now on a different playfield in terms of the cost of financing, and debt levels are high enough to lead to some corporate and maybe sovereign debt bonds to implode.

Defensive stocks — We favour stocks of businesses that have a strong cash flow generation, a ‘floor’ in the demand for the products they produce (demand inelasticity) and a healthy balance sheet. There are attractive dividend yields in the consumer staples and energy sectors.

Long agricultural commodities and Oil — We’ve cut some exposure to these commodities in the last few months and realized some losses, as prices of the asset class have continued to adjust down under fears of recession. However, we are still holding positions in our portfolio, expecting a strong rebound. Oil has already reached our entry point (85-70dpb), but we might wait for 65-60dpb before adding more. For agricultural commodities, we are still holding Coffee and Wheat. In the case of industrial metals, we are waiting for Copper to reach 3.7 before building positions there. And we got rid of Natural Gas positions during the last quarter, given the bearish price action. However, we are still watching it closely for macro and price action signs that reaffirm our expectation of a change in trend. This could happen soon given the historically low price levels it has reached.

Short US Bonds — We are still betting on a probable unhinging of inflation expectations, but it is still possible yields will head lower (and bonds’ prices higher) in a recessionary environment. With the US10y yield as a reference, we expect it to reach 3%-2.5% before we add to our long-term strategic position of net short US bonds.

Long USD — Taking the DXY Index as reference, the 105-100 levels were tested before the dollar resumed its upward trend, just as we expected in our las MacroView. If a Fed pivot takes place, the Dollar might lose ground, so it is prudent to reduce risk in this position. In general, we still favour dollar denominated assets, like T-bills and short-term debt.

Disclaimer

This report contains forward-looking statements within the meaning of the federal securities laws. Forward-looking statements are those that predict or describe future events or trends and that do not relate solely to historical matters. For example, forward-looking statements may predict future economic performance, describe plans and objectives of management for future operations and make projections of revenue, investment returns or other financial items. A prospective investor can generally identify forward-looking statements as statements containing the words “will,” “believe,” “expect,” “anticipate,” “intend,” “contemplate,” “estimate,” “assume” or other similar expressions. Such forward-looking statements are inherently uncertain, because the matters they describe are subject to known (and unknown) risks, uncertainties, and other unpredictable factors, many of which are beyond FESC Asset Management, LLC control. Actual results could and likely will differ, sometimes materially, from those projected or anticipated. We are not undertaking any obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise. You should not take any statements regarding past trends as a representation those trends or activities will continue in the future. Accordingly, you should not put undue reliance on these statements.

Actual results may vary substantially from past performance or current expectations. FESC makes no guarantees and no representations whatsoever related to any forward-looking statements or future results or events. The information contained herein is believed to be accurate as of the date of preparation, and FESC reserves the right to change and/or update such information at its sole discretion without prior notice. Investments are subject to market risk, including the complete loss of principal. Asset classes or investment strategies described may not be suitable for all investors. Equities and all other asset classes discussed herein are subject to market risk meaning that stock or asset prices, in general, may decline over short or extended periods of time.

The information contained does not consider any investor’s investment objectives, particular needs, or financial situation. Nothing in this material constitutes investment, legal, accounting, tax advice, or a representation that any investment or strategy is suitable or appropriate. FESC and its personnel gathered this information from publicly available sources, and we do not guarantee its accuracy.

The information herein is only a summary and does not purport to be complete. The information contained herein has been prepared by FESC solely for informational and discussion purposes only and is not for public distribution. This report does not constitute an advertisement, an offer to sell, or a solicitation of an offer to buy any securities or investment advisory services and is intended for informational purposes only. This presentation is strictly confidential and may contain private, proprietary, secret, and commercially sensitive information and may not be reproduced in any way or form or disclosed to any other person without the previous written consent of FESC.

Investment advisory clients, employees, and employee-related accounts may engage in securities transactions inconsistent with this report.

The above information is subject to change without notice. Additional information is available upon request.